Pay per hour after taxes calculator

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Federal and State Tax calculator for 2022 Hourly Tax Calculations with full line by line computations to help you with your tax return in 2022.

Untitled Tenders Bid Income Tax

Next divide this number from the.

. This makes South Dakota a generally tax-friendly state. How do I calculate hourly rate. That means that your net pay will be 43041 per year or 3587 per month.

There are two options. There also arent any local income taxes. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

The state tax year is also 12 months but it differs from state to state. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. How to calculate annual income.

For example for 5. Make Your Payroll Effortless and Focus on What really Matters. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Employees pay 145 from their paychecks and employers are responsible for the remaining 145. Youll pay 6500 in. Subtract any deductions and.

Use Gustos hourly paycheck calculator to determine. See where that hard-earned money goes - Federal Income Tax Social Security and. Our online Hourly tax calculator will.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Next divide this number from the. This places US on the 4th place out of 72 countries in the International Labour Organisation statistics for 2012.

Some states follow the federal tax. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Enter the number of hours and the rate at which you will get paid.

Expert articles and answers to all your questions. As mentioned above South Dakota does not have a state income tax. About Salary to Hourly Calculator.

It can also be used to help fill steps 3 and 4 of a W-4 form. For example if an employee earns 1500. It also has one of the lowest sales taxes in the nation with a base sales tax rate of just 45 though m unicipalities may impose a general.

Find out the benefit of that overtime. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Tax calculators checklists compensation tools and more.

Ad Manage HR payroll benefits and more from our industry leading all-in-one solution. For example for 5 hours a month at time and a half enter 5 15. Your average tax rate is.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Get a Free Payroll Quote Three Months Free.

You can personalise this tax. If you earn wages in excess of 200000 single filers 250000 joint filers or. Ad Compare 5 Best Payroll Services Find the Best Rates.

Salary to Hourly Calculator can help you. Texas Hourly Paycheck Calculator. This number is the gross pay per pay period.

Awesome Wireless Tax Infograph The Taxes Are Ridiculous Infographic Tax Wireless

How To Calculate Net Pay Step By Step Example

Hourly Paycheck Calculator Calculate Hourly Pay Adp

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Teaching Math Printable Signs

How To Calculate The Hourly Cost Of A Pickup Truck Pickup Trucks Pick Up Cost

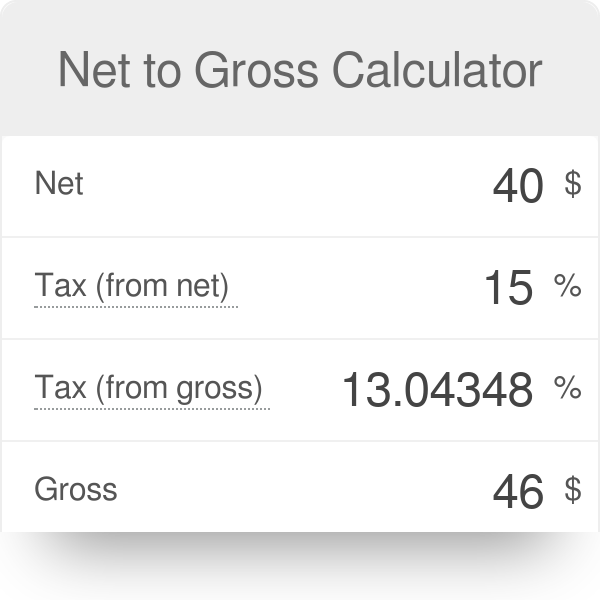

Net To Gross Calculator

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Accoun Paycheck Salary Oregon

Federal Income Tax Calculator Atlantic Union Bank

Centuryaccounting Posted To Instagram Do You Know The One Thing We Insist Every Taxpayer Should Do E File Their Ret Tax Refund Federal Income Tax Income Tax

New York Paycheck Calculator Smartasset

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Printable Tax Checklists Tax Printables Tax Checklist Small Business Tax

Excel Formula Income Tax Bracket Calculation Exceljet

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

Why Skilled Freelancing Is The Future And Its Advantages Online Taxes Tax Deductions Job Satisfaction